A Better Architecture for Autonomous AI

A solo founder building the infrastructure layer for autonomous AI agents — bootstrapped, lean, and revenue-focused from day one.

The OpenClaw Wrapper Bubble Is Built on a Broken Model

OpenAI just acquired OpenClaw — validating autonomous agents as the next platform shift. The explosion of wrappers in early 2026 produced 100+ competing offerings in weeks, with hundreds more in various stages of development. But they all share the same fundamental flaw: they are thin orchestrators spinning up individual VPS instances per agent. Now that OpenClaw has the backing of the world's largest AI company, the wave will only accelerate — and the broken model will break faster.

Always-On VPS per Agent

Every competitor spins up a dedicated VPS for each agent. Agents are idle 90%+ of the time, but you pay 100% of the time.

Race to the Bottom

Multiple wrappers listed for sale within days of launch. No moat, no differentiation — just reselling hosting.

Security as an Afterthought

Tenant isolation, secrets management, and credential scoping are bolted on — not built into the architecture.

No Path to Scale

Want 50 agents? That's 50 VPS instances to manage. 100 agents? Good luck. The cost and complexity grow linearly.

The Competitive Landscape

76 offerings identified. 10 already listed for sale. All use a VPS-per-agent model.

| # | Name | Category | Pricing | Status | Asking Price |

|---|---|---|---|---|---|

| 1 | SimpleClaw | Managed Wrapper | $29/mo per agent | For Sale | $275K |

| 2 | ClawHost | Managed Wrapper | $10–30/mo | For Sale | Unknown |

| 3 | ClawdHost | Managed Wrapper | $29/mo | For Sale | Unknown |

| 4 | ClawStack | Managed Wrapper | $9–39/mo | For Sale | ~$6K |

| 5 | SimpleClaw Shop | Managed Wrapper | $29/mo | For Sale | Unknown |

| 6 | RunClaw.sh | Managed Wrapper | $49/mo | For Sale | $50K (3.0x) |

| 7 | LobsterFarm | Managed Wrapper | $29–99/mo | For Sale | Unknown |

| 8 | OpenClawd Cloud | Managed Wrapper | $9–79/mo | For Sale | Unknown |

| 9 | BuiltWith OpenClaw | Managed Wrapper | Unknown | For Sale | $1.5K |

| 10 | iClawd | Managed Wrapper | Unknown | For Sale | $30K (5.1x) |

| 11 | LaunchClaw | Managed Wrapper | $19.99/mo | Active | — |

| 12 | ClawSimple | Managed Wrapper | $8.25/mo | Active | — |

Source: Product Hunt, X.com, GitHub, Hacker News, TrustMRR, Acquire.com, Indie Hackers, and industry analysis — February 2026. Virtually all competitors use a VPS-per-agent model. Asking prices sourced from TrustMRR and public listings.

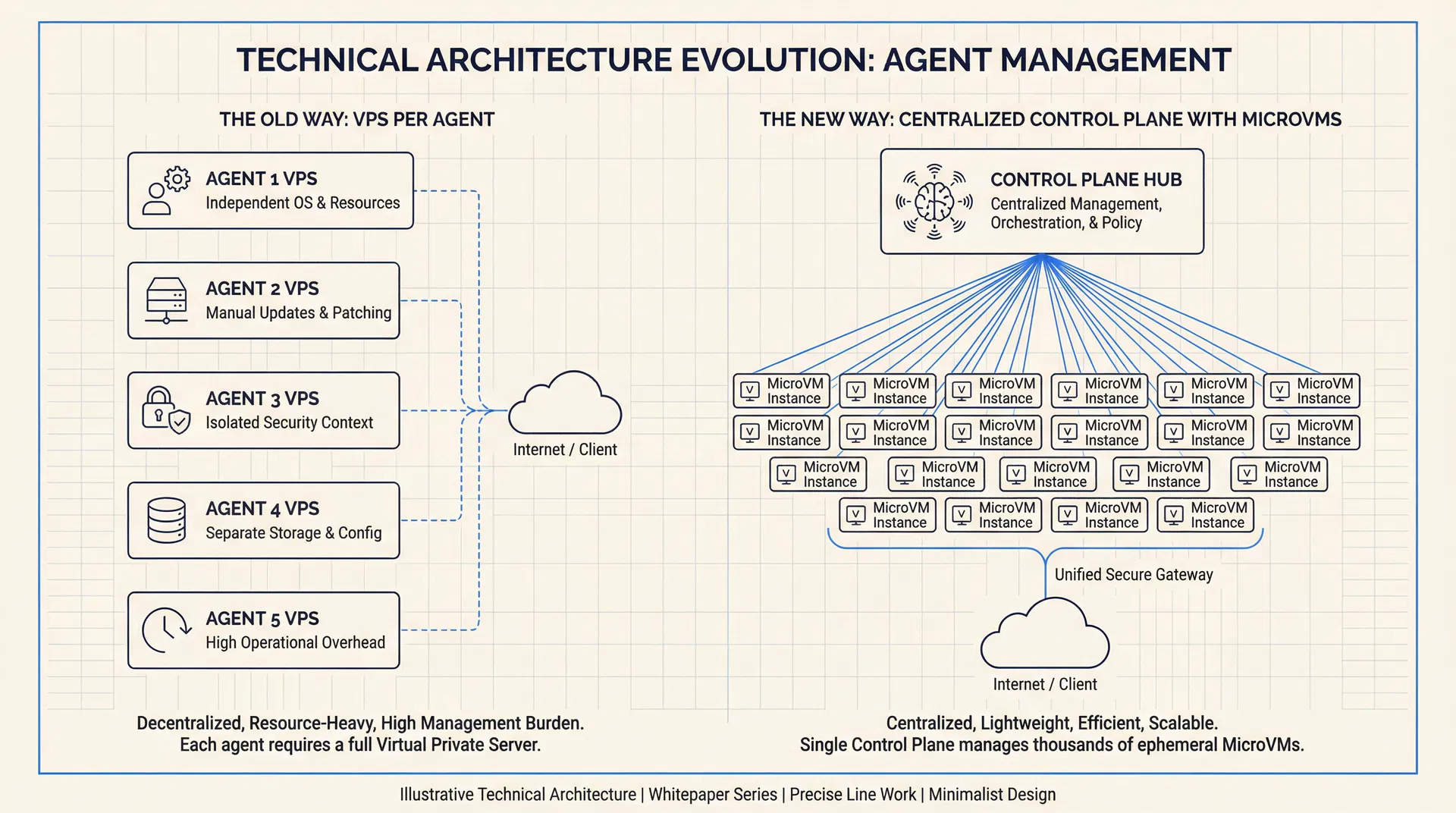

A Fundamentally Different Architecture

Instead of spinning up always-on VPS instances, we separate the always-on requirements (connections, scheduling, heartbeats) into a shared control plane, and use ephemeral Firecracker microVMs for the agents themselves.

Central Control Plane

WebSocket connections, heartbeats, and cron scheduling are managed at the control plane layer — not by individual bot instances.

Firecracker MicroVMs

Bot instances spin up in under 125ms using Firecracker, the same technology powering AWS Lambda. ~5 MiB memory overhead per VM.

Pay Only for Active Compute

Agents are idle 90%+ of the time. Our architecture only runs instances when actively processing, cutting costs by 10x or more.

Security by Architecture

Each agent runs in its own isolated microVM with a dedicated kernel. Tenant isolation and credential scoping are built in, not bolted on.

Cost at Scale: 100 Agents

Traditional wrappers charge $5–30/month per agent, with each running on an always-on VPS. Our architecture shares infrastructure at the control plane and only spins up microVMs when agents are active.

More Than Just a Wrapper

While every competitor offers a thin layer on top of OpenClaw, we have built a platform with three fundamental differentiators that create a lasting competitive moat.

Exponentially More Cost-Effective Architecture

Our control plane and Firecracker microVM architecture is fundamentally more efficient than the VPS-per-agent model used by every competitor. The always-on requirements — WebSocket connections, heartbeats, cron scheduling — live in a shared control plane. Individual agent instances only run when actively processing tasks, then spin down. This means an organization can deploy 100 agents for the cost of what competitors charge for 5.

Security-First, Multi-Tenant Design

Unlike single-instance wrappers where security is an afterthought, our platform is built for enterprise-grade isolation from the ground up. Each agent runs in its own Firecracker microVM with a dedicated kernel. A marketing bot gets Instagram credentials but never sees GitHub tokens. Agents can be assigned to specific team members with granular permissions. Secrets management and tenant isolation are architectural primitives, not features.

Brand-Agnostic Platform with Multi-Bot Orchestration

Our platform enables organizations to run multiple bots — each with its own soul, memory, and skills — all orchestrated through a single control plane. OpenClaw provides the "Souls" primitive; we provide the infrastructure to deploy, manage, and coordinate fleets of soul-bearing agents at scale. And the entire experience is white-labelable: Butlers.io targets enterprise, Squadmates.com targets teams, and StoreButler.com targets Shopify — all the same platform with a different coat of paint on top.

A Platform, Not a Wrapper

The primary business is a managed OpenClaw deployment platform for businesses. While every competitor sells thin wrappers, we sell infrastructure — a control plane that lets organizations deploy, manage, and orchestrate fleets of autonomous AI agents at a fraction of the cost.

Proving the Platform in Specific Niches

Each vertical is a branded instance of the same platform — a way to test product-market fit, generate early revenue, and demonstrate the architecture's versatility. Each can become its own business with its own market economics.

The pattern extends to any profession

One bot per entity, running on shared infrastructure, with domain-specific skills. Same platform, different coat of paint.

A Massive Wave — and a Bootstrapper's Edge

The AI agent market is exploding. I don't need to capture the whole wave — just carve out profitable niches where my architecture gives me a structural cost advantage. Three narrow verticals, each with clear willingness to pay.

Butlers.io / Squadmates.com — the managed OpenClaw platform for businesses. Need 100 teams at $99–249/mo = $120K–300K ARR. That's a fraction of the thousands already deploying OpenClaw agents.

Combined year-one target: ~$170K–350K ARR from the core platform plus three verticals. The platform is the primary revenue driver; verticals prove it in specific markets and generate independent case studies.

Market Size Projections by Source

| Source | 2025 Value | Projection | CAGR |

|---|---|---|---|

| Grand View Research | $7.63B | $182.97B (2033) | 49.6% |

| MarketsandMarkets | $7.84B | $52.62B (2030) | 46.3% |

| BCC Research | $5.7–8B | $48.3B (2030) | 43.3% |

| Fortune Business Insights | $7.29B | $139.19B (2034) | ~40% |

| KBV Research | — | $51.2B (2030) | 40.7% |

Demand Signals — February 2026

- OpenAI acquires OpenClaw — founder Peter Steinberger joins OpenAINEW

- Moonshot/Kimi launches OpenClaw-as-a-service — first model provider to bundle agent deploymentNEW

- OpenAI likely to offer OpenClaw-as-a-service next, validating the managed deployment thesisNEW

- 21,000 exposed OpenClaw deployments detected in one week

- SimpleClaw hit $29K revenue and listed for $275K sale — in under a week

- Hostinger, Contabo, and Northflank all launched OpenClaw hosting products

- Jason Calacanis dedicated 6+ TWiST episodes to OpenClaw in 3 weeks

- Enterprise adoption accelerating — AWS, CrowdStrike, Cisco publishing guides

Vision / Traction Organizer

Our strategic plan, structured using the Entrepreneurial Operating System's Vision/Traction Organizer framework — the same framework used by thousands of successful companies to align vision with execution.

VISION

- Security First: True autonomy requires a foundation of trust. Our architecture is built from the ground up with tenant isolation and robust security measures.

- Exponential Cost-Effectiveness: Democratizing access to autonomous AI by engineering a platform that is an order of magnitude more cost-effective than any other solution.

- Deep Extensibility: Empowering users to deploy and manage multiple bots — each with its own soul, memory, and skills — through a single orchestration layer.

- Intelligent Collaboration: Fostering a paradigm where agents share context and learn from each other, creating a network effect that enhances the entire system.

To build a lean, profitable platform that gives small teams and solo operators the same autonomous AI infrastructure that enterprises pay six figures for.

The bootstrapped, compliance-ready OpenClaw deployment platform. The core play is Butlers.io / Squadmates.com — managed multi-agent infrastructure for any business. Three beachhead niches (Shopify, DPC healthcare, independent RIAs) prove the platform in specific markets and generate independent revenue.

- Any business deploying OpenClaw agents that needs managed infrastructure, fleet orchestration, and cost-effective scaling (Butlers.io / Squadmates.com)

- Shopify store owners drowning in app sprawl who want a single AI assistant (StoreButler)

- DPC and concierge medical practices needing HIPAA-aligned patient automation (PatientBot)

- Independent RIAs and wealth managers needing per-client data isolation (ClientBot)

- DPC + concierge practices: "one bot per patient"

- RIAs / wealth managers: "one bot per client"

- Shopify (StoreButler): "one bot per store / workflow domain"

- Exponentially more cost-effective control plane + Firecracker architecture

- Security-first, multi-tenant design with VM-level isolation

- Brand-agnostic platform with multi-bot orchestration and white-label flexibility

- Launch StoreButler on Shopify App Store — organic discovery, self-serve onboarding

- Content marketing: technical blog posts, OpenClaw tutorials, compliance guides

- Direct outreach to DPC practices and independent RIAs through niche communities

- Revenue from subscriptions funds development of next vertical

- Each niche validates the platform and generates case studies for the next

"We offer the most cost-effective and secure platform to deploy and manage a fleet of OpenClaw agents. If you find a more performant solution at a lower cost, we will refund your subscription."

TRACTION

- Reach $15K MRR — $10K from Butlers.io/Squadmates.com platform, $5K from niche verticals

- Onboard first 100 paying teams on the core platform

- Launch StoreButler on Shopify App Store and acquire first 50 Shopify customers

- Pilot PatientBot with 2–3 DPC practices; begin ClientBot pilot with 1–2 RIAs

- Ship production-ready StoreButler and get listed on Shopify App Store

- Build self-serve onboarding — no sales calls needed for first 100 customers

- Develop lightweight compliance pack (audit logs, scoped secrets) for healthcare pilot

- Establish content marketing pipeline: 2 posts/month on OpenClaw deployment, compliance, architecture

- Complete UX refinement pass: streamline bot creation, skill assignment, and management flows

- Ship mobile-responsive web app (PWA) for on-the-go bot monitoring and chat

- Finalize StoreButler chat assistant and submit to Shopify App Store

- Launch benspitch.com and begin socializing with potential partners and advisors

- Set up basic analytics, billing (Stripe), and self-serve onboarding flow

Let's Build Together

I'm bootstrapping this from the ground up — solo founder, revenue-funded, full ownership. I'm not looking for a check. I'm looking for the right people to build alongside.

The Bootstrapped Path

Solo founder · Revenue-funded · Full ownership

The control plane is built. The architecture works. The MVP is nearly complete. I'm taking the bootstrapped path — starting with StoreButler on Shopify, then expanding into healthcare and financial advisory niches. Each vertical funds the next.

This isn't a "move fast and raise" play. It's a "build deep, own everything, and let the product speak" play. The architecture gives me a 10x cost advantage over every competitor. That margin is my runway.

I'm looking for advisors who've built in regulated verticals, early customers who want to pilot, and strategic partners who see the same opportunity. If this resonates, let's talk.

Advisors & Mentors

Experienced founders who've bootstrapped in regulated verticals

Early Customers

Shopify stores, DPC practices, and RIAs willing to pilot

Strategic Partners

Complementary tools and platforms in our target niches